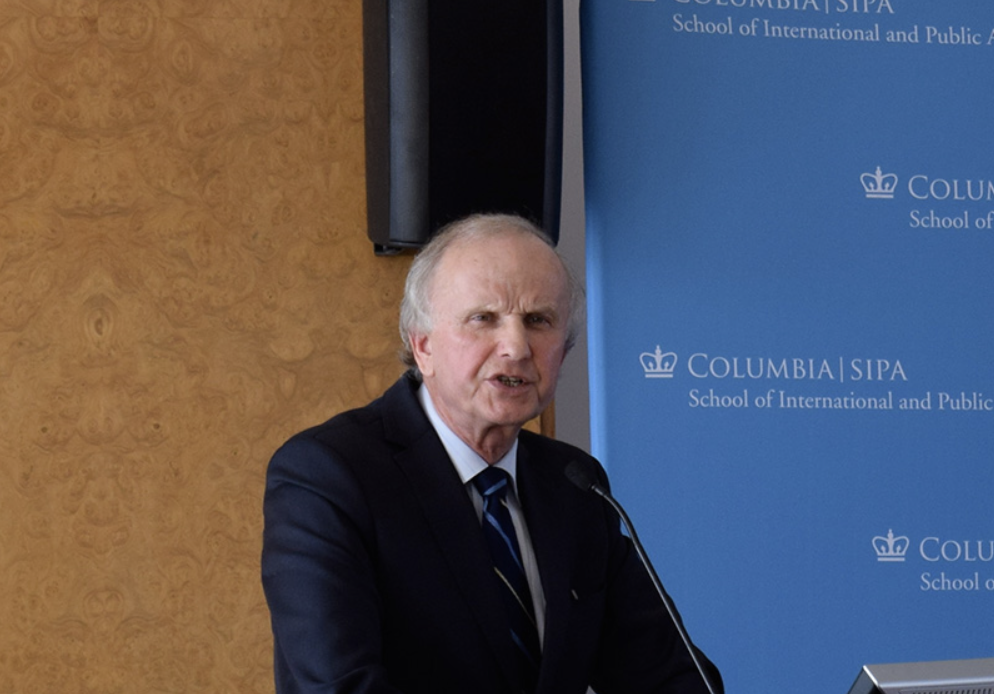

“Economics will not save the world, but it can help it a lot. So whither the world? Do we know a lot about it or do we have no clue.” This thought-provoking question is posed by Professor Grzegorz W. Kolodko, Former Polish Deputy Prime Minister and Finance Minister, in the opening of his new book Whither the World: The Political Economy of the Future. Offering his invaluable insight on the topic of the long-term future of the global economy, Professor Kolodko addressed a packed audience on Tuesday, April 21, 2015 at Columbia’s School for International and Public Affairs at a book talk sponsored by the Center on Global Economic Governance, the Center on Capitalism and Society, and the Initiative for Policy Dialogue.

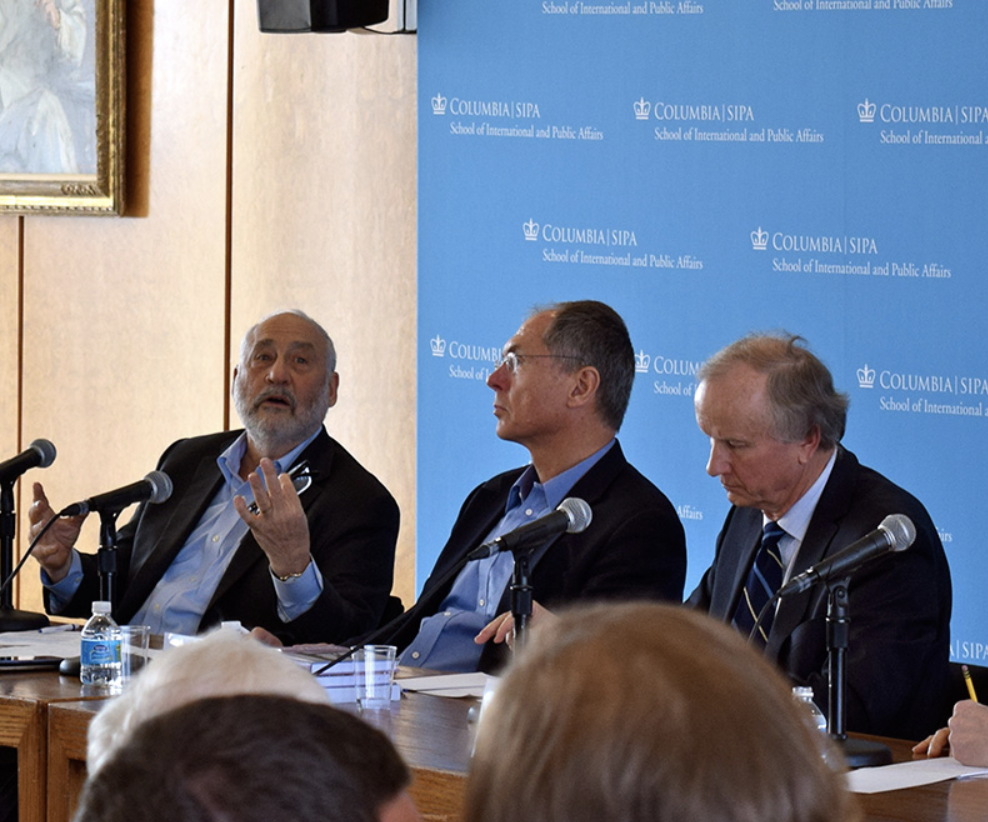

In attendance at the book talk were Professors Joseph Stiglitz, Edmund Phelps, and Jan Svejnar of Columbia University. Professor Kolodko opened the talk by asking what would happen with global economic growth, competitiveness, balancing of the world’s economies, regionalization, and globalization in the decades to come. In a blunt appraisal of the world’s economic, political, and social realities, Professor Kolodko outlined a path forward for countries to take in balancing their economies.

Professor Kolodko continued his talk in outlining the need for a new kind of capitalism. On the one hand, neoliberal capitalism, he argues, has created a system in which financial markets have enriched the few at the cost of the many. On the other hand, state capitalism of the likes of Belarus and Venezuela have created problems of their own with regards to democratic deficits and innovation. He advocates for a new pragmatic kind of capitalism that is much more socially oriented, based on a hetero-orthodox thinking in the context of irreversible globalization and regional integrative processes. These economies can be deemed as ‘Emancipating Economies’ that sustain triple bottom-line development concerning economic growth, social cohesion, and ecological balance.

In response, Professor Phelps countered that the global economy doesn’t need to be governed in any thorough way, but needs governance on particular points. Professor Phelps emphasized that the entire West has been in an economic malaise that predates the present crisis. He hypothesized that the cause of this malaise lies in the deficiency of innovation in nations once counted on to provide it – France, the US, the UK, among others. Innovation depends on the dynamism of the society and must originate in countries’ respective economies, rather than brought in from exogenous forces. Thus, Europe must be, as he argued, fueled by the energy of its people and task off the blocks and inhibitors to innovation.

Professor Stiglitz similarly presented an alternative argument for future governance of the global economy. He posited that there is no absence of cohesion among international institutions in regulating the global economy, rather it is the way the rules are made that govern the economic structure. Finance Ministers and Central Banks make key decisions on the financial system, but they see the world through the eyes of the financial community. That may be important, he argued, but only a part of what makes a successful economy grow. This leads to a global governance structure that creates more inequality and an economic system unable to cope with drastic cyclical changes.

Professor Svejnar concluded the panel remarks by stating that we are witnessing one of the most rapid changes of economic rebalancing the world has ever seen, within such a short time period. Despite all the shortcomings that had been identified by the panelists, Professor Svejnar suggested that the capitalist system is still a system that has created incredible flexibility and flow of innovation.

In closing, Professor Kolodko stated that the global economy must be managed, but questions remain on how to do it. In the decades to come, he argues that the biggest question will be how to manage the synergy between the power of governments and the market. What makes a successful economy is balance; “I would say that [states] do not have to expand to be happy. But if you are imbalanced, you will not be happy.”